Why So Many Mergers & Acquisitions Fail — And How to Beat the Odds

TL;DR: Why Most M&A Deals Miss And How To Beat The Odds

The stat that matters

- 70–90% of deals don’t deliver the value leaders expected. Treat that as a warning light, not trivia.

Why they fail

- Overpaying. Ego, FOMO, and rosy models push multiples too high. The math squeezes you later.

- Weak fit. If the target doesn’t match your core strengths, customers, and operating rhythm, scale becomes bloat.

- Integration gaps. Culture clashes. Systems don’t talk. Decision rights unclear. Customers confused. Key leaders leave.

- Execution drag. Synergies show up slower than the spreadsheet. Complexity explodes. A-players disengage.

- External shocks. Rates, regulators, recessions. If your foundation is shaky, these finish the job.

Why roll-ups and add-ons are extra risky

- Deployment pressure leads to “good enough” buys at bad prices.

- Ten businesses. Ten back offices. Zero scale. Customer experience fractures.

- Founder resistance and leadership bandwidth get ignored until it’s too late.

The hidden thread

- People and culture drive or destroy value. Not perks. Clarity, trust, decision rights, and aligned leaders.

What to do before you buy or sell

- Pressure-test fit. Does this make your core stronger or just bigger?

- Model the human side. Day 1 communication for customers and employees. Know who owns what.

- Invest in leaders. Retain and coach the ones who carry the integration.

- Simplify first. Fix your own complexity before you add more weight.

- Build a playbook. Models are guesses. Operating rhythms keep you on track.

For sellers

- Transferable value wins. Right people in right seats. Documented systems. Sticky customers. That raises multiples.

For buyers and platforms

- Capacity and accountability are the constraints. Standardize systems early. Align leadership. Communicate relentlessly.

One-line summary

- Buying a company is easy. Integrating it is where value is won or lost.

30-second checklist

- Fair price? Clear fit? Named owners for every integration workstream? Single source of truth for data? Day 1 scripts for customers and staff? Leadership retention plan? Weekly integration cadence with visible scorecards?

If you’re serious about beating the odds

- Get an outside operator to pressure-test assumptions, align leaders, and install the operating rhythms before the ink dries. That’s the work.

If you’ve been in business long enough, you’ve probably heard the stat: most mergers and acquisitions don’t work. Depending on who you ask, somewhere between 70–90% of deals fail to deliver the value leaders expected.

That should make every business owner pause. Because on the surface, M&A feels like the perfect growth lever. Buy a competitor, tuck in a smaller shop, or sell to a bigger player — suddenly, the business is bigger, stronger, and more valuable.

At least that’s the theory.

The reality is much messier. Customers leave. Employees disengage. Systems don’t line up. The deal that looked like a shortcut to growth becomes a drain on time, money, and focus.

But here’s the good news: the reasons most deals fail are predictable. Which means they’re preventable.

This guide breaks down:

- The most common reasons M&A deals miss the mark

- Why private equity roll-ups and add-ons are especially risky

- The thread that ties almost every failure together (and what to do about it)

- Practical steps you can take to protect your investment or prepare for an exit

- How the right operating system and leadership discipline change the odds in your favor

Why Most M&A Deals Fail

M&A failure doesn’t come from one bad move — it comes from a combination of forces. Some of them are financial. Others are operational. But more often than not, they’re human.

Let’s talk about the most common reasons.

Overpaying and the Illusion of Growth

When companies chase acquisitions, one of the easiest traps to fall into is overpaying. On the surface, it looks like momentum. A deal gets done, headlines are written, and leaders celebrate a “transformational” win. But beneath that excitement is often a simple mistake: paying a premium for growth that doesn’t exist.

Emotions drive a lot of these decisions. A founder doesn’t want to lose territory to a rival. A CEO wants to make their mark with a big deal. A PE fund has dry powder burning a hole in its pocket, and partners want to show their LPs activity before the investment window closes. That’s when discipline tends to crack. Multiples climb higher. Forecasts get rosier. Everyone convinces themselves it will work out.

The problem is that math doesn’t lie. When you pay too much on the front end, you leave yourself no margin for error. Suddenly, every missed synergy or integration slip eats directly into the return. The “winner” of the bidding war often becomes the loser in the long run.

Take an HVAC company doing $25M in revenue. A regional platform circles the deal, convinced it’s the perfect fit. They project all the textbook synergies: consolidated purchasing to lower costs, unified marketing to capture more leads, and recruiting advantages from being the “bigger player.” But as the auction heats up, ego and fear of missing out push the price higher. The buyer ends up paying 15x EBITDA just to win.

On paper, it works. The spreadsheet says they’ll earn it back through synergies. In reality, it looks very different:

- Customer loyalty is thinner than expected, and competitors poach accounts.

- Key managers who were critical to operations leave after the sale.

- The tech stack is a Frankenstein of incompatible systems, creating operational chaos.

What looked like a growth play turns into an expensive distraction.

And here’s where it gets even harder: once you start too high, you feel pressure everywhere else. Margins get squeezed. Leaders start looking for quick wins, cutting corners, or pushing employees harder to close the gap. Growth strategies turn desperate. Instead of being empowered by the acquisition, the business becomes trapped by it.

This is why sober strategy matters more than deal volume. The best acquirers aren’t the ones doing the most deals — they’re the ones doing the right deals, at the right price, for the right reasons. And that requires more than just financial modeling. It requires clarity of vision, disciplined leadership, and the ability to separate ego from execution.

That’s where outside guidance comes in. At Eightfold Advantage, we’re not here to tell you what multiple to pay. That’s between you and your bankers. What we do is help you test your assumptions, pressure-check the “why” behind the deal, and think clearly about the risks that may not show up in a spreadsheet. When you have a team that can strip away the noise and keep you grounded, you’re far less likely to fall into the illusion of growth that comes from overpaying.

Weak Strategic Fit

If overpaying is the first way deals go sideways, poor fit is a close second. Leaders see an opportunity, fall in love with the numbers, and convince themselves it’s the right move — even when the business they’re buying doesn’t actually align with who they are.

The danger here is that almost anything can be rationalized in a spreadsheet. Need growth? Project some cross-sell opportunities. Want to diversify? Add a new geography. Looking to impress investors? Talk about “platform potential” and “one plus one equals three.”

On paper, it all looks airtight. In practice, if the companies don’t share the same DNA, the whole thing is built on sand.

I once saw this play out with a marketing agency that acquired a home services company. The deal promised immediate diversification, new revenue, and exciting cross-promotional opportunities. But the agency thrived on creativity, speed, and client campaigns, while the contractor thrived on consistency, process, and operational efficiency. Those are very different rhythms. Within 18 months, the mismatch became impossible to ignore. Customers were confused, employees frustrated, and leadership burned out. Eventually, the deal unraveled.

This kind of misalignment shows up everywhere in roll-up strategies too. A PE group might string together a handful of small contractors thinking they’ll create scale. But if the customer bases are different (residential vs. commercial), the service models are different (low-cost vs. premium), or the cultures are different (family-run vs. corporate-driven), the platform doesn’t really scale — it bloats. Complexity goes up. Margins go down.

The truth is, fit matters more than size. Bigger is not always better. A smaller deal that aligns tightly with your strategy will almost always create more value than a flashy acquisition that doesn’t actually belong.

So how do you know if a deal fits? You start by getting brutally clear about yourself.

- What is your business truly great at?

- Where are you going over the next five years?

- What values and cultural traits define your team?

- What systems and processes are non-negotiable?

Once you’re clear on those, you can hold every potential deal up against that mirror. If the target business strengthens your core, it’s worth a deeper look. If it pulls you off course, no amount of spreadsheet acrobatics will save it.

This is one of the reasons we spend so much time at Eightfold Advantage working with leaders on clarity. You can’t evaluate fit if you don’t know who you are and where you’re headed. We help leadership teams articulate their unique strengths, define their long-term vision, and build an operating system that scales. That way, when the right opportunity comes along, you’ll know it — and when the wrong one shows up dressed like a winner, you won’t be fooled.

Integration Failures

If there’s one area that consistently sinks M&A deals, it’s integration. Over and over again, studies confirm this. Bain found that 83% of failed acquisitions point back to poor integration as the primary culprit.

The reason is simple: leaders underestimate just how hard it is to stitch two businesses together.

On paper, the logic seems straightforward. Combine two sets of customers, align teams, consolidate back office, and realize synergies. In reality, the process is messy, emotional, and far more complex than most leaders bargain for.

Cultures clash. Imagine one company that thrives on speed and informality. Decisions are made in hallway conversations, and employees pride themselves on being scrappy and flexible. Now merge that with a company that values caution, process, and clear chains of command. Suddenly, every decision becomes a source of frustration. The first group thinks the new parent is “bureaucratic.” The second group thinks their new colleagues are “reckless.” Neither side feels understood, and employees start heading for the exits.

Systems don’t line up. It’s not uncommon to see one company running a modern system like ServiceTitan, while the other is spread across three or four outdated CRMs or accounting platforms. Reconciling data becomes a nightmare. Teams spend months re-entering information, reconciling reports, and trying to make workflows talk to each other. Instead of saving time, the integration eats it. What looked like operational efficiency becomes operational paralysis.

Key leaders leave. This is one of the most painful dynamics. A founder may stick around just long enough to collect the check, then quietly disengage. A COO may feel sidelined by the new org chart and resign. Suddenly the acquired business is leaderless at precisely the moment when it needs strong direction the most. Retention bonuses can soften this, but they don’t solve cultural fit or the loss of influence some leaders feel.

Customers get confused. One of the most underappreciated risks in integration is what happens to customers. They start asking: Who do I call now? Will pricing change? Is the quality the same? In the absence of clear communication, customers assume the worst. Competitors are quick to exploit the uncertainty. A few high-value accounts walk out the door, and the entire financial model starts to wobble.

That’s why it’s critical to stop thinking about integration as something you’ll “figure out later.” Integration isn’t a back-office project. It is the deal.

The companies that get this right treat integration as a core part of the strategy from day one. They don’t wait until closing to start planning. They map out which systems will survive, which will be retired, and how long the transition will take. They define decision rights early so teams know who owns what. They identify cultural gaps and create a plan to bridge them — not ignore them. And most importantly, they communicate relentlessly with employees and customers.

Integration is also a leadership issue. No amount of process will make up for a vacuum at the top. If there aren’t strong, aligned leaders guiding both sides of the deal, the best playbooks in the world won’t stick. That’s why leadership retention and coaching matter. You need the right people in the right seats, with the authority and clarity to carry the integration forward.

At Eightfold Advantage, this is where we often step in. We don’t write the purchase agreement or design the financial model. But we do help leadership teams prepare for the real work that starts after the papers are signed. We help you create the communication rhythms, accountability systems, and cultural clarity that keep integration on track. Because without those, no spreadsheet in the world can save you.

Operational and Execution Risks

Even when the deal thesis is sound — the valuation is fair, the strategic fit makes sense, and the integration plan is thoughtful — execution can still collapse under its own weight. This is where many leaders get blindsided. They assume that once the “big stuff” is figured out, the rest will fall into place. But in reality, the day-to-day grind of running the business after a merger is where things either hold or unravel.

Synergy math doesn’t add up.

This one is almost universal. Leaders and advisors build models that assume cross-selling and upselling will kick in immediately. Procurement savings will show up within months. Shared services will cut costs in half. The reality? Customers don’t cross-buy as quickly as you think. Procurement contracts don’t always deliver the savings you modeled. And shared services often take longer to implement — or cost more — than anyone expected. What looked like a conservative estimate on paper turns into a best-case scenario that never arrives.

Customers leave during the “distraction window.”

This might be the most dangerous hidden risk. While leadership is busy aligning org charts, reconciling systems, and sitting in endless integration meetings, customers notice a dip in service. Phones don’t get answered as quickly. Projects slip. Communication feels fuzzy. And competitors are always watching for an opening. They’re more than happy to swoop in and pick off frustrated clients. The cost of a few key defections can wipe out months of supposed “synergy gains.”

Employees disengage.

Change fatigue is real. After the initial excitement of the deal, many employees are left wondering: What does this mean for me? Who do I report to now? Am I still valued here? If leaders don’t provide clarity, people disengage. Some coast. Others quietly look for new jobs. The people you were counting on to drive execution are suddenly no longer in the game. And if your top performers are the ones to leave, the damage multiplies.

Complexity overload.

This one sneaks up on leadership. The new org chart looks impressive — multiple divisions, expanded leadership teams, new committees. But instead of creating clarity, it creates drag. Meetings multiply. Decisions crawl. Nobody is sure who has the final say, so everything requires alignment across layers. The very structure that was supposed to unlock scale becomes the reason speed stalls.

At its core, execution risk is about capacity. Do you actually have the leadership bandwidth, the operational systems, and the accountability mechanisms to handle the weight of a larger, more complex business? If not, the cracks show quickly.

That’s why at Eightfold Advantage, we push leaders to strengthen their foundation before they add more weight. We help make sure the right people are in the right seats. We put in place operating systems that give clarity instead of confusion. And we help leadership teams build rhythms of accountability that keep everyone focused on what matters most. Because growth doesn’t expose your strengths — it exposes your weaknesses. If you don’t shore them up ahead of time, execution risk will find them for you.

External Factors

Finally, there are forces outside your control.

- Antitrust regulators put conditions on the deal.

- Interest rates climb, making debt loads unmanageable.

- A recession hits, erasing the growth you were counting on.

- Competitors seize the moment to lure away customers and employees.

You can’t control these, but you can prepare for them. Businesses with strong leadership, resilient systems, and disciplined execution weather storms far better than those running on duct tape.

Why Add-Ons & Tuck-Ins Fail for PE Platforms

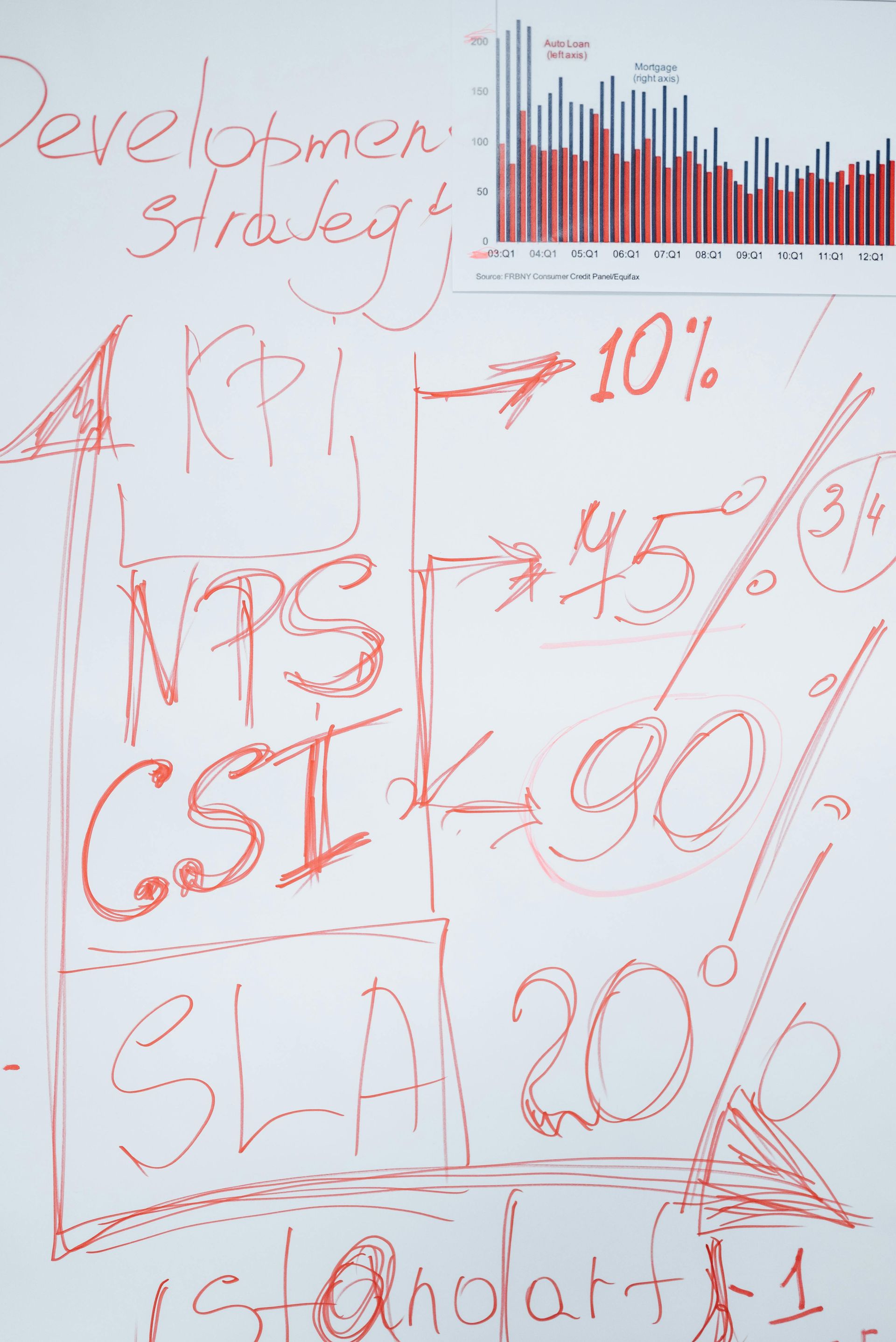

If you’re in private equity, you already know: add-ons are the engine of platform growth. They’ve become the dominant strategy. In fact, roughly three out of every four buyouts today are structured as add-ons.

The logic is straightforward. Buy a strong platform company, then bolt on smaller businesses to expand geography, services, or customer base. The roll-up gains scale, increases valuation multiples, and everyone wins.

At least, that’s the idea.

In practice, add-ons and tuck-ins are where many platforms stumble. They’re supposed to be the growth accelerators — but without discipline, they become the anchors that weigh everything down.

Deployment Pressure and Overpaying

One of the quietest killers in private equity is simple deployment pressure. Funds raise capital with a mandate to put it to work. The investment clock is ticking, LPs expect activity, and partners feel pressure to keep deals moving.

That pressure often leads to deals that look “good enough” rather than truly great. A business gets acquired not because it’s the right strategic fit, but because it was available and the platform needed to show progress.

Layer in hot sectors — like SaaS, healthcare, or medtech — and the problem amplifies. Multiples get bid up quickly. Suddenly, a tuck-in that might have been a sensible 8x deal is closing at 12x or 15x. By the time the ink dries, the platform has already overpaid.

And once you overpay, you’re trapped. Every missed synergy hurts more. Debt coverage tightens. The margin for error disappears.

The best funds know this. They resist the temptation to chase volume. They don’t measure themselves by how many deals they announce but by how many deals actually create value. They’re patient. They walk away from bad fits. And they keep underwriting discipline even when everyone else is chasing frothy valuations.

Neglected Integration and Scaling Risks

Buying companies is easy. Integrating them is hard.

Every tuck-in brings its own systems, processes, and culture. Payroll, HR, IT, finance, sales — each company shows up with a different way of doing things. If those aren’t streamlined, the platform becomes more bloated, not more efficient.

I’ve seen platforms with 10, 15, even 20 businesses under one umbrella. On the outside, it looks impressive. But on the inside, each business is still running its own back office. Ten payroll systems. Ten accounting systems. Ten different ways of tracking sales. Instead of economies of scale, they’ve built a patchwork quilt of inefficiency.

What’s worse, the lack of integration often shows up in customer experience. Inconsistent branding, different service standards, and disjointed processes erode trust. Instead of presenting as one strong, unified platform, the business feels like a loose federation of independents.

The solution isn’t glamorous, but it works: standardize systems, consolidate back office, and align reporting. That takes time and discipline. It requires leadership buy-in. But without it, the very reason you pursued a roll-up — efficiency and scale — never materializes.

Leadership Gaps and Cultural Resistance

Another common failure point in roll-ups is leadership bandwidth. A platform CEO or management team can only stretch so far. Without strong operators inside each tuck-in, execution collapses.

Founder-led businesses, in particular, struggle here. Many of them were built by grit, hustle, and a deeply personal leadership style. When they’re suddenly asked to fall in line with “corporate” reporting structures, they resist. What used to feel like freedom now feels like bureaucracy.

Without alignment, resentment builds. Culture clashes turn into attrition. Suddenly, the tuck-in you bought for growth is hemorrhaging talent and morale.

This is why leadership planning matters. Integration isn’t just about systems and processes; it’s about people. You need the right leaders in the right seats, with clear roles and aligned incentives. And you need coaching to help founders-turned-operators navigate the transition from independence to integration.

At Eightfold Advantage, this is often where we get called in. We help platforms put real operators in place, coach leadership teams through the cultural shifts, and build accountability systems that prevent things from falling through the cracks. Because if the people inside the tuck-in aren’t bought in, no amount of systems consolidation will save it.

Macro and Regulatory Shocks

Private equity models often rely on leverage. When interest rates rise or reimbursement rules shift (especially in healthcare), the math breaks.

You can’t predict these shocks, but you can build margin for error. Healthy leadership teams, adaptable systems, and strong culture give platforms the resilience they need.

The Hidden Thread: People and Culture

If there’s one theme that cuts through every failed deal, it’s people.

Financial models don’t deliver value. People do.

You can have the sharpest bankers, the most airtight legal documents, and the cleanest Excel models in the world — but if the people inside the business aren’t aligned, engaged, and committed, the deal will fall apart.

And this is the part that too many leaders underestimate. They treat culture as a “soft” issue. Something nice to have once the hard numbers are squared away. In reality, culture is a balance sheet issue. It determines whether customers stay or leave, whether employees buy in or burn out, and whether leaders can pull in the same direction when the pressure’s on.

Why culture breaks deals

One study by Mercer found that nearly 30% of failed integrations were due to culture clashes. Another from Bain revealed that integration problems — most of which are human at their core — are cited in more than 80% of failed deals.

Here’s what that looks like in practice:

- Employees need clarity.

After an acquisition, people are asking:

Who’s my boss now? How do I get promoted? Are my benefits changing?

Without clear answers, productivity drops. A-players get frustrated and leave. The employees who remain are the ones who tolerate confusion — and that’s not who you want driving the next stage of growth.

- Customers need reassurance. Think about the client who’s been loyal for years. They’re not reading your financial statements. They’re noticing whether their account manager still picks up the phone. If the tone changes, the response times slip, or the service feels different, they’ll go shopping. Competitors love an acquisition announcement because it opens the door for them to whisper: “Things aren’t the same over there anymore.”

- Leaders need alignment. This is the hardest one. When an acquisition happens, leadership roles almost always shift. A COO who used to make decisions unilaterally now reports to someone else. A founder who used to be the face of the business is suddenly just another executive in the org chart. If those dynamics aren’t managed with clarity and care, resentment festers. The very people you were counting on to make the deal successful may quietly (or loudly) disengage.

Culture isn’t about perks.

Too many companies confuse culture with surface-level perks. They think if they throw a few happy hours or give out branded t-shirts, they’ve solved the problem. But culture isn’t about pizza parties. It’s about trust, clarity, and alignment. It’s about whether employees feel like they’re part of something they want to fight for — or something they want to escape from.

What strong culture looks like in M&A

In integrations that succeed, culture becomes a force multiplier. Leaders anticipate the friction points and deal with them head-on. They over-communicate, not just with investors but with frontline employees. They take the time to articulate shared values. They acknowledge differences instead of sweeping them under the rug. They make tough calls quickly about which practices survive and which don’t. And most importantly, they put the right leaders in place — people who can model the new culture and carry others with them.

What weak culture looks like is the opposite. Leaders avoid hard conversations. They hide behind financials, assuming employees and customers will “figure it out.” They allow silos to form, where “old company vs. new company” language takes root. They cling to multiple sets of processes, never forcing a unified way of working. Over time, the cracks widen until they’re impossible to ignore.

How we help

At Eightfold Advantage, this is the space we live in. We’re not your banker or your lawyer. We’re the partner who makes sure your leadership team and operating system are ready for the human realities of M&A.

- We make sure you’ve got the

right people in the right seats, so execution doesn’t stall.

- We help you

build cultures that people

want

to stay in, even when change feels uncomfortable.

- We install

accountability rhythms and communication cadences that keep everyone focused and aligned.

- And we give leaders the tools to manage change without burning out their teams.

When culture is strong, integration accelerates. People stay. Customers stay. Leaders push through the messy middle of integration and actually get to the value creation they promised.

When culture is weak, it doesn’t matter how clever your financial engineering is. The model won’t hold, because the humans carrying it out won’t be there.

That’s why, if you’re buying, selling, or rolling up add-ons, the smartest investment you can make isn’t just in due diligence — it’s in culture diligence. Prepare your people. Align your leaders. Clarify your values. Because if you get the human side right, the financial side has a fighting chance.

Practical Steps to Protect Value

So what can you do to improve your odds?

Here are steps every acquirer, seller, or platform builder should put into play:

- Pressure-test the strategic fit. Ask: does this deal align with who we are, what we’re good at, and where we’re going?

- Model the human side.

Day 1 communication to employees and customers isn’t optional. Have a plan.

- Invest in leadership. Retain key executives. Coach them. Incentivize them.

- Simplify before scaling. If your business is already complex, adding more will only multiply the chaos.

- Build a playbook, not just a model. Financial models rarely survive first contact with reality. Operating playbooks do.

Each of these is practical, but they take discipline. And that’s where a coach comes in — not to run the deal, but to prepare your people and systems to handle it.

A Better Way Forward

M&A can be the fastest way to grow a business — or the fastest way to destroy value. Which way it goes depends less on the deal size and more on the discipline, clarity, and leadership behind it.

Too often, leaders treat M&A like a finish line. Sellers assume that once the purchase agreement is signed, they can relax. Buyers assume that once they’ve closed, the value is already locked in. But in reality, that’s when the hard work begins.

For owners preparing to exit:

Selling your business is one of the biggest decisions you’ll ever make. You want to capture the value you’ve built over years — maybe decades — of hard work. But buyers don’t just look at financials. They look at leadership depth, culture, customer loyalty, and operational resilience. If your business depends entirely on you, or if your team is stretched thin, your valuation suffers.

Preparing early changes that. When you’ve got the right people in the right seats, documented systems that hold up under pressure, and a culture that retains top talent, buyers see less risk. Which means they’ll pay more. A company with clarity and discipline doesn’t just sell faster — it sells stronger.

For buyers and platforms:

Acquiring another company looks like a growth shortcut. But without the right foundation, it becomes a growth trap. If your team doesn’t have the capacity, accountability, and culture to handle integration, the very deal that was supposed to accelerate you will slow you down.

Platforms especially need to be wary here. Roll-ups aren’t about how many logos you can put on a slide — they’re about whether all those businesses can function as one. That requires leadership alignment, system standardization, and cultural integration. If those aren’t in place, scale creates drag instead of value.

The Eightfold Advantage approach:

This is the space we live in. At Eightfold Advantage, we help owners, leadership teams, and PE groups prepare for the realities of M&A. We’re not your banker. We’re not your attorney. We’re the guide who makes sure the people, culture, and operating system inside the business are ready to succeed on the other side of the deal.

That means:

- For sellers: building transferable value that increases your multiple.

- For buyers: equipping your team to integrate without losing customers, employees, or momentum.

- For leadership teams: creating clarity so growth doesn’t devolve into chaos.

Because in M&A, it’s never just about the transaction. It’s about what happens next.

If you’re considering a sale, an acquisition, or a platform strategy, now is the time to prepare. A single 25-minute conversation could save you months of headaches and millions in lost value.

👉 Schedule your 25-minute call with Eightfold Advantage today.

Key Takeaways

- Most M&A deals fail because of overpaying, poor fit, and integration mistakes.

- Add-ons and tuck-ins are especially risky when systems and leadership aren’t prepared.

- Culture is not soft — it’s the #1 factor that drives or destroys value.

- The right people, right systems, and right playbooks make integration work.

- Leaders who prepare before a deal dramatically increase their odds of success.

Before you go:

If you knew your next deal had an 80% chance of failing, what would you do differently today to change the outcome?